The Dumpster Fire You Agreed To

Let’s talk about TPA and insurance, which are two hard-to-understand words that are buried in the fine language of your health plan. It’s like having to choose between getting ghosted by a hot person or getting breadcrumbed by a not-so-hot person. You still don’t know if you’re the idiot or if the system is broken (hint: it’s both). But being an adult is more than just sobbing into a $7 oat milk latte while watching “The Office” at 3 AM.

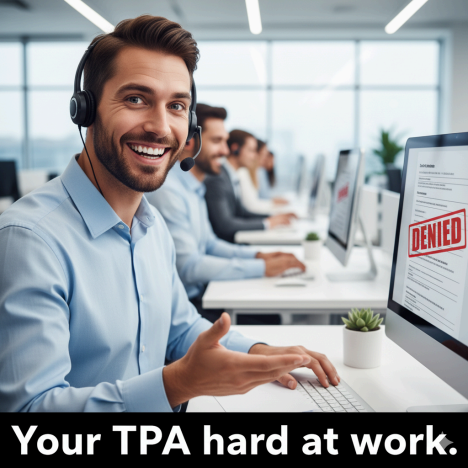

Let’s look at these two and see who is more likely to screw you over: the insurance company or the Third-Party Administrator (TPA), who is always there to help.

The Head of Pain and Premiums at the Insurance Company

Insurance, huh? The leader of the healthcare crime syndicate. Big Brother watches you and makes a bizarre promise: “If you get sick, maybe we’ll help… if we’re in the mood.” You pay him every month.

You pay your premiums every month, just like you do for Netflix, but instead of making you happy, they pay for a stranger’s yacht.

Coverage: That magical word that makes you think you’re protected, but then you find out that routine dental care isn’t included because teeth aren’t part of your body. Good.

Claims: The Hunger Games of paperwork, where 12 people will submit and only 1 will live.

To be honest, insurance companies are like the HOA for your health. They say they’re “protecting the community,” yet if you leave your trash cans out for too long, they only make you feel bad.

The TPA: The Personification of Middle Manager Energy

The Third-Party Administrator, or TPA, is now here. These people are like the intern who suddenly became your boss. They don’t write the rules, but they definitely do enforce them with a lot of energy.

They “handle” claims. Which is just a clever way for firms to indicate that they are putting your costs into a black hole of red tape.

You can think of them as the individuals who take care of your health insurance. You know, the people who send you letters that say stuff like, “According to our policy, we can’t grant your request.” It means “We hate you, Karen.”

They talk to you about your insurance like an ex who has their roommate inform you it’s over.

In short, your TPA is like the middle kid between you and your insurance. They want to feel significant, yet most of the time they merely make things worse.

Who’s Actually Worse? Yes, there is a spoiler.

It’s like trying to decide which is worse: the insurance company lying to you about “out-of-network fees” or the TPA who gives you a rejection email at 11:59 PM on a Friday. They are both horrible, but in different ways.

The insurance firm is in charge of all enterprises. Picture them as Mark Zuckerberg with a stethoscope: strong, intimidating, and for some reason, they don’t like being human.

TPA stands for “The Painful Middleman.” The person who makes sure your pain is on time and fulfills Section 4, Subparagraph C.

They are the Bonnie and Clyde of having money troubles. One steals your money right away, and the other gives you the documents to make you think it was legal.

Your Mind and Your Money Are the Real Victims

Let’s be honest: you don’t stay up at night wondering what a third-party administrator does for enjoyment. You’re lying awake at night, gazing at a hospital bill and wondering if your TPA paid for the $85 worth of Tylenol you didn’t realize you were charged for.

And you know what? No, they didn’t.

Do you have health insurance? What does TPA mean? Not a big deal. You are using Venmo to pay money to your hospital like it’s a crazy OnlyFans account for doctors who sweat.

And don’t forget that when you call your insurance company, they’ll say, “That’s the TPA’s fault.” If you send an email to your TPA, they will instruct you to “Ask your insurance.”

And you’ll sit there, shoving your forehead into the foam of your cappuccino, knowing that you’re paying two fools to fight in your email while you lose money.

It’s sending off terrible emotions about relationships. But you can’t just cut off their phone; you need them to keep alive. Yay for capitalism!

TL;DR (Because Your Head Hurts)

It’s the insurance companies that break their commitments. TPAs are the overzealous people who rush around making sure you know your claim is denied in MLA manner. Both of them are there to keep things confusing so you don’t fight back.

In the end, congratulations, you’re doomed but you know it.

It’s not about choose which one is better; it’s about realizing that you’re stuck with both of them in a never-ending three-way that you never consented to.

But at least now you know which one to hate more when you have a mental breakdown at Starbucks next time. Good luck paying off that $300 bandage, champ.

Final Thought

Let’s be honest: nothing hurts more than finding out that you have to pay for two complete corporate environments just to see a doctor who can confirm that you indeed have the sickness.

Your TPA is probably sending you refusal letters like breakup texts, and your insurance company is probably using your premiums to buy another ping-pong table for the workplace.

So, the next time someone tries to tell you the difference between TPA and insurance, just remember this: one is the magician and the other is the helper. But your wallet is always the rabbit that goes missing.

Ta-da!