Welcome to the Student Loan Circus

So, you finally became an adult. You survived insurance bills, gym memberships you never used, and warranties that only work in fairy tales. Now comes the grand finale: student loans.

Let’s be honest. Nobody warned you that getting a degree comes with a side of financial anxiety that could outlast your first apartment lease. You didn’t sign up to spend decades paying for education while debating whether ramen noodles count as a balanced meal. But here we are.

Whether you’re a young earner looking for safe investment options, a beginner investor worldwide, or a professional planning long-term wealth building, knowing how student loans really work is essential.

Why Student Loans Keep Growing

Tuition isn’t getting cheaper. It’s more like a rollercoaster that only goes up.

- Colleges keep raising fees – You thought $25k/year was bad? Try $40k for your freshman year housing and tuition combined. Yikes.

- Living expenses are no joke – Rent, food, textbooks, and yes, TikTok breaks count as necessities now.

- Studying abroad is fancy, but expensive – Airfare, visa fees, and international tuition can make your loan double before you even unpack.

The promise of education as a golden ticket? Real. The cost of that ticket? Your bank account crying softly in the corner.

Interest Rates: The Silent Killer

Here’s the math no one wants to admit: borrow $30,000 at a 6% interest rate. Over 20 years, you could pay back around $52,000. That’s a $22,000 surcharge just for existing.

Many students choose lower monthly payments because “future me” will figure it out. Spoiler: future you is broke, stressed, and contemplating whether a second job at Starbucks is a career move.

Even for retirees exploring low-risk diversified portfolios, this is a reminder: debt compounds fast, and it isn’t playing fair.

The Global Student Loan Problem

Student loans aren’t just a U.S. thing—they’re everywhere.

- United States: $1.7 trillion in student debt, with repayment periods stretching decades.

- United Kingdom: Loans tied to income, but interest piles up anyway.

- India & Asia: High-interest private loans for overseas programs are normal now.

- Europe: Tuition may be lower, but living costs can still bury you.

So yes, even if you’re part of a global audience interested in financial planning and mutual funds, student loans can shape your life no matter which country you live in.

Repayment Options: Avoid Financial Heart Attacks

Good news: you have options. Bad news: they all involve paperwork.

- Standard Repayment Plans – Same payment every month for 10–20 years. Predictable, but painful.

- Income-Driven Plans – Payments adjust based on your salary. Friendly now, but you’ll be paying longer.

- Graduated Plans – Start small, grow over time. Ideal if your raises actually happen.

- Refinancing & Consolidation – Combine loans for lower interest. But check the fine print—you don’t want to lose federal protections.

Think of it like mutual fund diversification for beginners: balancing risk now prevents financial disasters later.

Loan Forgiveness & Other Hacks

Some programs forgive loans, but don’t get too excited:

- Public Service Loan Forgiveness (PSLF): Only for U.S. government/nonprofit workers.

- Teacher Loan Forgiveness: Only for certain schools and regions.

- Scholarships & Grants: Apply aggressively. Even a $500 grant feels like winning the lottery.

- Employer Assistance: Some companies chip in, but usually only for the lucky ones who found a unicorn job.

Most students, though, will still end up paying off loans well into their 30s or 40s.

How to Borrow Smart

If you don’t want student loans to eat your soul:

- Borrow only what you need – That $50k offer is not an invitation to splurge.

- Max out scholarships & grants – Every dollar saved is a small victory.

- Budget early – Track spending, even for coffee runs.

- Make small extra payments – Even $25/month chips away at interest.

- Invest while repaying – Contribute to retirement or safe mutual fund options worldwide. Compound interest is your friend here.

Little moves now can save you from a lifetime of debt-induced nightmares.

The Emotional Reality

Student loans aren’t just financial—they’re a mental marathon.

- Patience: decades of repayment.

- Stress: interest keeps climbing.

- Negotiation: endless calls to lenders with hold music designed to break your spirit.

You’ll have nights staring at your balance, questioning all life choices that led here. Honestly, sometimes paying for therapy might feel cheaper than tuition.

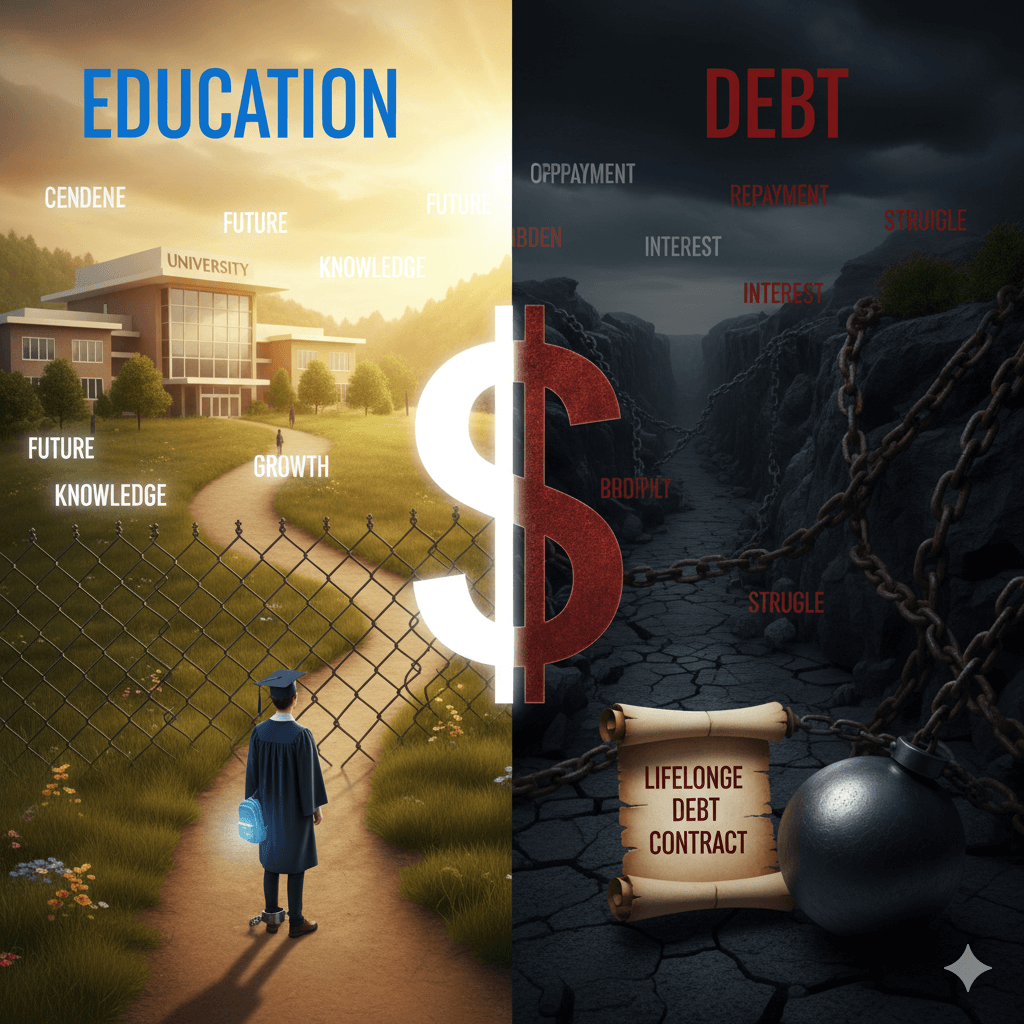

Conclusion: Education or Debt?

Student loans are both a ladder and a trap. They give access to education but demand years of repayment. The trick isn’t to demonize them—it’s to play smart:

- Know exactly what you’re borrowing.

- Pick repayment plans that suit your future income.

- Combine repayment with long-term wealth-building strategies.

For professionals planning long-term wealth building or retirees exploring low-risk portfolios, loans are a harsh teacher: manage debt early, and you’ll breathe easier later.

Bottom line: education is priceless, but student loans don’t have to own your life. Borrow smart, plan strategically, and maybe—just maybe—you’ll graduate without crying over instant noodles every night.